Game Theory and Election 2010: Why ‘Punishing Dems’ is the Right Thing to Do Tactically AND Morally

By: hctomorrow Tuesday September 14, 2010 11:36 pm

A common refrain in the lefty blogosphere is that you have to support the candidate with a D after their name, even if they repeatedly betray your causes and ideals, because the Republicans are worse. They’ll repeal all the ‘great’ legislation the Democrats have passed over the past two years, and continue all the terrible policies the Democrats have unfortunately continued – policies which are also, conveniently, the Republicans’ fault.

However, game theory teaches us something quite different – that cooperation without the threat of retaliation for betrayal is a sucker’s game.

The Prisoner’s Dilemma

To see why, let’s back up a bit. First, what’s Game Theory? From Wikipedia:

Game theory is a branch of applied mathematics that is used in the social sciences, most notably in economics, as well as in biology (particularly evolutionary biology and ecology), engineering, political science, international relations, computer science, and philosophy. Game theory attempts to mathematically capture behavior in strategic situations, or games, in which an individual’s success in making choices depends on the choices of others.

In essence, it’s roleplaying as science. To try and understand what the best strategies are when dealing with other actors, you set up a mock version, either on a computer or for kicks in real life, and play out the various strategems, measuring which is more successful and what the pitfalls are. The results can often be surprising.

One of the most famous experiments in game theory is the ‘Prisoner’s Dilemma’. Again, from Wikipedia:

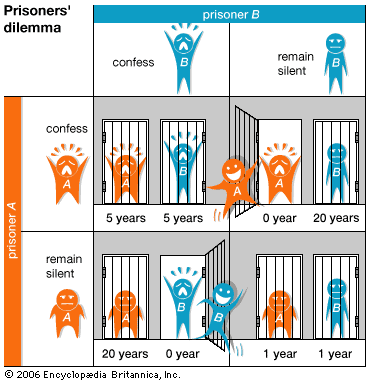

The prisoner’s dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so. It was originally framed by Merrill Flood and Melvin Dresher working at RAND in 1950. Albert W. Tucker formalized the game with prison sentence payoffs and gave it the "prisoner’s dilemma" name (Poundstone, 1992).

A classic example of the prisoner’s dilemma (PD) is presented as follows:

Two suspects are arrested by the police. The police have insufficient evidence for a conviction, and, having separated the prisoners, visit each of them to offer the same deal. If one testifies for the prosecution against the other (defects) and the other remains silent (cooperates), the defector goes free and the silent accomplice receives the full 10-year sentence. If both remain silent, both prisoners are sentenced to only six months in jail for a minor charge. If each betrays the other, each receives a five-year sentence. Each prisoner must choose to betray the other or to remain silent. Each one is assured that the other would not know about the betrayal before the end of the investigation. How should the prisoners act?

Obviously, the prisoners would be better off if they cooperated – 1 year’s combined jail time is a lot better than 10, which is the result if either betrays the other, or both do. However, it’s not *rational* to cooperate – no matter which choice your opponent makes, betraying them increases your benefit. If they cooperate, you stab them in the back and walk free. If they stab you, you protect yourself by backstabbing them.

A pretty bleak assessment of human nature, eh? The problem here is accountability, or rather, the lack thereof. Remember the setup: the police make sure neither prisoner can confer with the other until after the decision has been made, and you only get to make it once.

If accountability is added, however, things turn can turn out very differently.

The Iterated Prisoner’s Dilemma, aka Politics

If you set up a game where the players have to run through that same scenario multiple times, with memory of what happened before, things turn out differently, and different strategies succeed. If you defect every time, your opponent is free to, and indeed only rational to follow your example. Likewise, however, if you cooperate every time, your opponent can see an easy mark and take advantage.

Wikipedia again:

Retaliating

However, Axelrod contended, the successful strategy must not be a blind optimist. It must sometimes retaliate. An example of a non-retaliating strategy is Always Cooperate. This is a very bad choice, as "nasty" strategies will ruthlessly exploit such players.

Herein lies the fundamental flaw in always voting Dem just because Republicans are worse, and we have decades of math to back it up. If you always cooperate, your opponent will face enormous temptation, arguably selection pressure, to defect and betray you. It’s only a matter of time, and what’s more, they face absolutely no penalty for doing so – you’ll just cooperate again the next round.

If, on the other hand, you are willing to retaliate, a more successful strategy can be devised.

Tit for Tat

As it turns out, cooperating all the time and defecting all the time are both proven losers, given repeat performances. So what works?

It turns out, a combination of the two. I’ll let Carl Sagan explain this one (from his essay ‘The Rules of the Game’, collected in Billions and Billions):

The most effective strategy in many such tournaments is called "Tit-for-Tat." It’s very simple: You start out cooperating, and in each subsequent round simply do what your opponent did last time. You punish defections, but once your partner cooperates, you’re willing to let bygones be bygones. At first, it seems to garner only mediocre success. But as time goes on the other strategies defeat themselves, from too much kindness or cruelty, and this middle way pulls ahead. Except for always being nice on the first move, Tit-for-Tat is identical to the Brazen Rule. It promptly (in the very next game) rewards cooperation and punishes defection, and has the great virtue that it makes your strategy absolutely clear to your opponent. (Strategic ambiguity can be lethal.)

The problem for Progressives is that we’re being told to, and have in the past often utilized an Always Cooperate strategy.. and our partners in elected office learned that long ago, and are exploiting it.

On gay rights, on immigration, on financial reform, on restoring the rule of law, on putting torturers on trial, on unions and the free choice act, on escalating unwinnable wars, on fighting the legalization of marijuana, on just about any and almost every single Progressive issue you can name the current Democratic party has defected. Why?

Because it’s a winning strategy to defect if you know your opponent will always cooperate; in fact, it’s the absolute best strategy to employ.

The Way Ahead

The only way we can expect to stop the exploitation is to show our would-be-defectors in the Democratic Party that we’ve woken up, once and for all, and are willing to retaliate when defected from. Yes, if we do so, we’ll lose in this round of our iterated game. We might, in fact, lose very badly indeed.

The alternative, however, is clear, from both game theory and common sense: the exploitation will *never* stop. Never. Let’s be very clear; the current dilemma Progressives face with their estranged counterparts does not stem from a lack of understanding; the party understands us all too well. It isn’t the result of Dems failing to learn from past mistakes; on the contrary, they’ve learned exceptionally well from ours.

http://seminal.firedoglake.com/diary/71423

Kuhn Poker Solved: Win Money With Game Theory

Yesterday I posted the rules of the very cool Kuhn poker. Here's optimal play:

Playing first:

Interestingly, you can either check or bet a King or a Jack—this is poker, after all and in this case bluffing/slow-playing is as good as playing your cards straight. But holding a Queen is tricky: If you bet, your opponent folds with a Jack or raises with a King. Half the time, you win your opponent's one-chip ante, and half the time you lose your ante plus your bet.

This is not good. In fact, it's bad. You're losing twice as many chips as you're winning.

So you check.

Now your opponent only checks if holding the Jack and you win the one-chip ante. If your opponent bets he/she either has the King or is bluffing with the Jack. So calling this bet wins half the time (assuming your opponent is an ice-cold bluffer). If you call, you've got two chips versus two chips in a 50/50 pot; if you fold, you lose your ante every time.

So your best strategy when holding the Queen and playing first is to check and then call if necessary. Unfortunately, even this optimal strategy loses 1/18th each hand.

So you'd rather play first (see above).

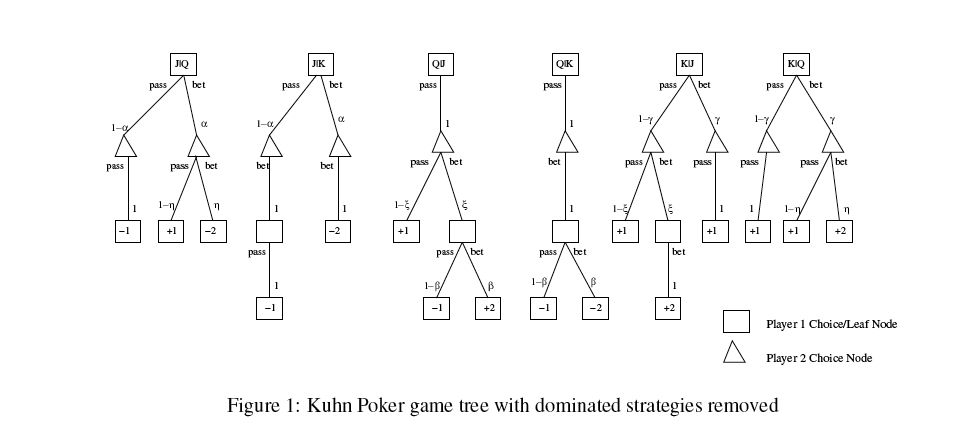

For serious Game Theory geeks, here's the decision tree, with dominated strategies (the bad ones) already removed:

?Can Game Theory Improve Business Strategy

Because of my previous post, I discovered a book called ‘The Art of Strategy’ by Dixit and Nalebuff. I had read their first book called ‘Thinking Strategically’ published in 1993. Its focus is game theory applications in business discussing bargaining, unconditional moves, and vicious circles. It is fairly focused on dealing with opponents, which was – like Sun Tzu – quite popular at the time. When I wrote my first Novel ‘Deity’ in 2003, game theory was an intriguing subject that played a big part for a quantum computer who could not only predict, but influence the future. Game theory uses mathematical models to analyze decision-making for strategy, in which one individual’s decisions are based on the assumptions what the actions of other actors might be. When each player has adopted a strategy to play, an equilibrium can be reached. But that was only the beginning.

The great minds of game theory are John von Neumann, Oskar Morgenstern and clearly John Nash for non-cooperative games. Most game theories are based on the idea of utility, meaning a rational, measurable benefit that one player can gain by acting a certain way. Game theory assumes that humans actors use similar abstract concepts in the sense of epistomology (what can be known) for their decision-making and for deciding upon actions. Not only the knowledge of the players is different, but most likely also their concepts of knowledge can be quite different. Our rationality needs however a model of reality to understand the means to act in a desired manner. It is in fact impossible for the decision-maker to know the complete state space and consequently all the possible actions by other players are not reasonably predictable as possibilities. It is therefore not surprising that behavorial economics discovered that most human decision-making is not based on rational utility. Some does even seem rather irrational, when it really isn’t, but uses heuristics such as bounded rationality (Gigerenzer et.al.) to decide under uncertainty. Evolutionary game theory assumes therefore no rationality or bounded rationality for its players and considers both biological and cultural evolution as well as individual learning.

Game Theory is thus still in development and only in 2007 Myerson, Hurwicz, and Maskin were awarded the Nobel Prize in Economics for their work in reverse game theory or mechanism design. They worked on game types where the rules of a game are actually designed while it is being played, with the designer having an interest to influence it’s outcome. Those concepts deal much more realistically with the real world of human-made rules and laws. It does have a strong similarity to the concepts of Adaptive Processes. One of the key elements is the necessity to extract information from the players that they would rather not divulge. The need to gather dependable decision-making information from uncooperative agents is a real business management problem.

I find these theories truly interesting in terms of mathematics, but with little practical application, mostly because of the mentioned epistomological modeling problem. All theoretical results are built on well-defined and controlled models that do not translate to the real world. The findings indicate however that the human mind can be dreadfully misled by thinking that these model concepts are real. In for example contract theory, a decision maker applies an optimization algorithm to achieve a ‘complete’ contract. He attempts to motivate players to take desired actions as maximizers of von Neumann-Morgenstern utility functions. Expected utility decision-making ASSUMES however the probability of various outcomes, thus the expected value of decisions is extremely sensitive to the assumptions, particularly with rare extreme events, a.k.a. as Black Swans. Enter the recent financial crisis!

Applying game theory for business strategy or management thus faces many obstacles, because doing business is in most cases not like a sequential or simultaneous game but an unknown mix of both with an unknown set of players under substantial uncertainty. Each real-world actor has a long tree list of dependent decisions to take that ought to be looked forward and reasoned backward in theory. Because the knowledge and possible actions of other players are mostly based on pure assumptions, it is a good strategy to retain the ability to change course en-route or allow for the renegotiation of agreements. Only in a few cases is reducing your options beneficial as an undoubtable signal, such as Cortés did in 1519 by scuttling his ships at Veracruz. He was intent to make his signals believable, because he also massacred thousands of the Aztec nobility to convince emperor Montezuma to capitulate.

What can we then learn for business from the study of game theory?

To burn your bridges or threaten your employees? I guess not. Yes, it is important that executives and managers send clear signals that are trustworthy. There is no difference, as asserted repeatedly by Dixit and Nalebuff, between employee and children behavior. “Either do this or else …” has to be followed by actions that assert the consequences. I see however the aspects of information exchange and information congruency for decision-making as the most important elements. The problem of ‘what we can know’ must be taken care of in business by creating a common information model for all players inside the business. Not a data model for programmers, but an information model for business people. Finally, empowerment ought to be used to motivate all players to act transparently and fill the model with realistic data. The “… or else …” is what I call boundary rules as an essential element of empowerment.

Bain & Company found in studies that 70% of all reorganizations do not improve anything and some actually worsen the state of the business. Next to a lack of accurate information, the core reason is that decision-making is not aligned with authority given. As only a few substantial changes can be executed at one time, change should not happen in Big-Bangs but continuously from the bottom-up by empowered employees. Also Forrester Research recently published a book focused on the subject, aptly named “Empowered.”

‘The Art of Strategy’ left me however dissatisfied, I guess because it retraces much of the original book with different examples and stories about threats, challenges and promises. While the book deals with strategically anticipating your opponent’s moves, it employs simple, counterintuitive common sense. Concepts like ‘put yourself in the opponents shoes’ and ‘actions speak louder than words’ are commonly accepted perspectives that I would not consider a scientific sensation. Also ‘countersignaling’ is not a new idea, explaining that those who belong don’t need to signal (=brag), while someone who i.e. lacks scientific credentials enforces the use of his PhD title. I have often said that the most prominent feature in ads is most likely the weakest aspect of a product. But competing by louder and more ads isn’t always the best approach. When cigarette TV advertizing was banned, tobacco companies fought it as they thought it would hurt them, but in fact because all companies suddenly did not have to compete through TV ads it substantially raised tobacco profits.

In conclusion it seems that most successful strategies are random chance and not achieved by applying a ‘complex systems thinking’ approach that tries to model all the complex dependencies of actions and reactions of all players in advance. Gut feelings and ‘guts to act’ are clearly more important than strategic models of business games, according to Gigerenzer. What remains for a business to improve is the need for real-time transparency to improve decision-making and for empowerment to translate the decisions into action. The business hierarchy is not about command and control but about proper role play in the business game. The executive needs to set strategic objectives, that are translated into targets by management, linked to goals by process owners, and executed as tasks by people skills to fulfill the customer outcome. Yes, doing business can be seen as a game, but it won’t be improved by theories and methodologies, but by empowering people with information technology and the means to fulfill the goals.

While a fool with a tool remains a fool, trying to execute a great strategy without the best in tools is plain dumb. A fool that needs a methodology to manage is outright dangerous. A wise general will create a strategy based on weapons technology available on both sides, because not to do so is gross negligence or even murder.

What can we take away from all this? Well, the concepts of information exchange in Game Theory support the importance of IT for running a business. The executive who designs a business strategy without understanding what information technology can provide and how the competition uses it, is endangering the future of his business.

Therefore, strategy has to follow real-world technology and not some theory.

بیولوژی

Scientists at the University of California, San Diego’s Center for Theoretical Biological Physics have been using theoretical mathematics, chemistry, and physics to model the genomic and proteomic interactions among colonies of Bacillus subtilis under conditions of environmental stress.

Under stress, a bacterium faces two options. It can undergo sporulation, a process that involves more than 500 genes, in which the bacterium places a copy of its genome in a durable capsule known as a spore. These spores, which are extremely durable even during harsh conditions, can then germinate into new bacteria. The mother cell that sacrifices its genome to form the spore then bursts open releasing its intracellular contents to the environment.

The other option for the bacterium is to enter the “competence intermediate state” in which it makes its membrane more permeable to its extracellular environment so that it can assimilate the cellular contents released by other bacteria that have sporulated. Though this option may allow for survival, the bacterium risks death.

UCSD physics professor José Onuchic explains how these two options present a Prisoner Dilemma-like predicament: “It pays for the individual cell to take the risk and escape into competence only if it notices that the majority of the cells decide to sporulate. […] But if this is the case, it should not take this chance because most of the other cells might reach the same conclusion and escape from sporulation.”

The conclusion of the “game” is that only ten percent of the bacteria enter the “competence intermediate state.” The scientists have found that the decision a bacterium makes is dependent upon the chemical signals being released by its neighboring bacteria. Moreover, though the researchers keep refining their studies, they conclude that stochastic processes still pervade the decisions the bacteria make. Onuchic explains: “Another interesting fact is that the same cells in the same environment, in this case, bacteria in the colony, can actually in a statistical matter choose two different outcomes: sporulation or competence.”

The researchers hope their studies will have applications in sociology, economics, and even cancer biology.

Game Sec 2010

http://www.gamesec-conf.org/papers.php

Game Sec 2010

Conference on Decision and Game Theory for Security

November 2010, Berlin, Germany

List of Accepted Short Papers

Oligopolies and Game theory

http://www.youtube.com/watch?v=AOEbJF0k8vM

Oligopolies and Game Theory: Econ Concepts in 60 Seconds with Mr. Clifford

Politics and game tneory

Students were agitated, donors threatened to withdraw funding and an ambassador warned of unilateral sanctions.

در زندگی بازیهای بسیاری انجام میدهیم ‘ خواه برای سرگرمی و کودکانه ‘ خواه برای سوداگری و سود آوری ‘ یا حتی عاشقانه‘

در زندگی بازیهای بسیاری انجام میدهیم ‘ خواه برای سرگرمی و کودکانه ‘ خواه برای سوداگری و سود آوری ‘ یا حتی عاشقانه‘